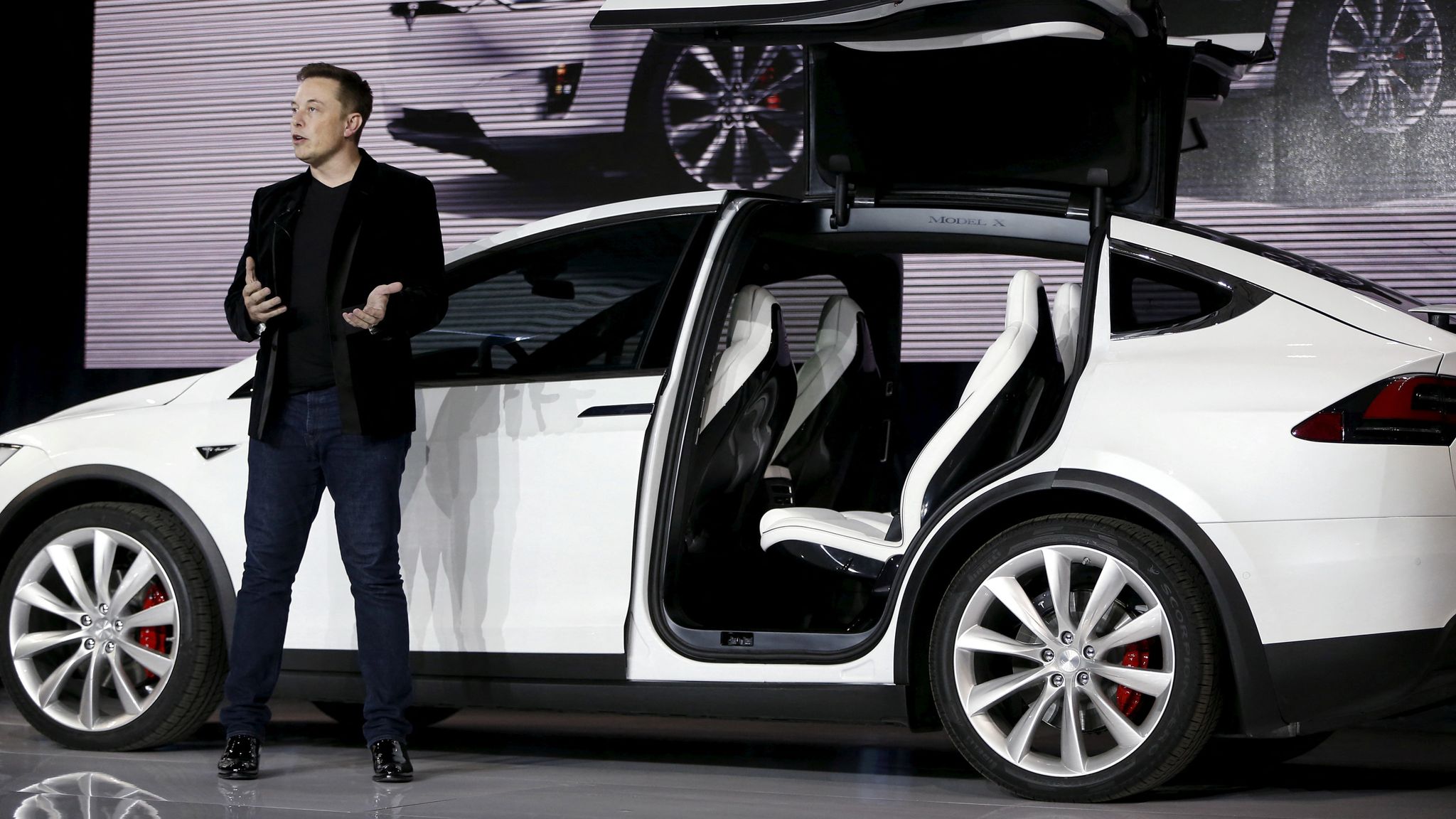

Elon Musk has proven that returning to the office, with full focus and relentless dedication, can have dramatic effects—not only on his companies but on the broader financial markets.

After months of political distractions and controversial endorsements, Musk announced via his social media platform X that he is recommitting to working “24/7” and will be “super focused” on his business ventures.

This revelation immediately sent Tesla shares soaring nearly seven percent on Tuesday, signaling investors’ optimism that Musk’s renewed attention will propel the electric vehicle giant forward amid a volatile economic landscape.

The benefits of return-to-office mandates have been debated extensively, with studies showing mixed results. While some suggest that hybrid or remote workers can maintain productivity comparable to in-office employees, others emphasize the intangible advantages of physical presence, particularly for mentorship, innovation, and hands-on training.

Musk’s commitment appears to be an extreme but clear example of how immersion and physical presence in the workplace can translate into investor confidence and market momentum.

Musk’s recommitment comes at a crucial moment. Tesla’s recent reputation, especially in Europe, has been tarnished by Musk’s political maneuvers, including his endorsement of Germany’s far-right AfD Party.

This endorsement contributed to a staggering 49 percent year-over-year drop in Tesla’s April sales on the continent, according to data from the European Automobile Manufacturers’ Association.

Investors, eager for Musk to distance himself from politics and concentrate on business, reacted positively to his announcement. The sharp rise in Tesla’s stock price contrasts with broader tech market fluctuations, reflecting a focused faith in Musk’s leadership and vision. Other tech giants followed suit on Tuesday with notable gains, including AMD, Apple, and Microsoft.

These companies were buoyed not only by their own performance but also by optimistic signals on the trade front. U.S. President Donald Trump’s surprising Sunday announcement of a pause on 50 percent tariffs imposed on the European Union sparked relief across markets, as did comments from National Economic Council Director Kevin Hassett, who suggested further trade agreements could materialize within days.

These developments lifted key indices: the S&P 500 surged over two percent, breaking a four-day losing streak, while the Dow Jones rose nearly two percent and the Nasdaq climbed nearly two and a half percent. Even Europe’s Stoxx 600 index gained modestly, with Germany’s DAX hitting a record high.

While the markets celebrate these gains, the underlying geopolitical and economic tensions remain unresolved. The tech sector faces persistent challenges, especially given the Trump administration’s aggressive tariff policies targeting key global markets like China and the European Union.

Nvidia’s upcoming earnings report is emblematic of this uncertainty. The company, a leader in graphics processors, faces a looming $5.5 billion write-down on inventory due to export restrictions imposed by the administration. This looming hit casts a shadow over Nvidia’s strong sales growth and adds an element of caution for investors.

:max_bytes(150000):strip_icc()/GettyImages-2158237831-e8786b4cd18e46529ace73b2fed838dc.jpg)

Tesla’s resurgence on the stock market, fueled by Musk’s recommitment, may thus serve as a stabilizing factor. As the company’s CEO pivots away from divisive political involvement to prioritize his businesses, confidence appears to be returning among shareholders.

Musk’s intense focus is not just a personal strategy but a market signal that leadership matters profoundly in times of economic turbulence. The announcement also comes against a backdrop of significant corporate developments beyond tech.

In the steel industry, Nippon Steel of Japan is set to acquire U.S. Steel for $55 per share, a deal that has been cleared by President Trump after initially facing regulatory hurdles. U.S. Steel’s shares reflected the positive momentum, climbing sharply after the announcement and closing near $53.

This acquisition underscores broader trends of international consolidation and the intertwining of corporate strategy with political decision-making. At the consumer level, optimism is on the rise.

The Conference Board’s Consumer Confidence Index revealed a sharp rebound in May, reaching 98.0—well above expectations and signaling renewed faith in the U.S. economy.

This optimism is attributed largely to progress in resolving trade tensions with China, following months of uncertainty and decline in consumer sentiment. The shift represents a hopeful turning point, though experts caution that sustaining this momentum will require continued policy stability and tangible economic improvements.

Yet despite these encouraging signs, some market analysts warn that gains may be temporary. JPMorgan Chase cautions that the S&P 500 could remain rangebound in the near term, suggesting that Tuesday’s rally might not herald sustained upward movement. Investors are advised to consider hedging strategies, such as purchasing call options, to protect against potential downturns amid ongoing volatility.

Meanwhile, outside the traditional tech and industrial sectors, more fragile markets like the diamond industry are grappling with the impact of tariff policies. Diamonds, though made of the hardest material on earth, are highly vulnerable to complex global supply chains and trade disruptions.

The U.S., which consumes over half of the world’s polished diamonds, imposes a baseline 10 percent import duty, with the possibility of additional tariffs if recent pauses on trade measures expire without new agreements.

Industry leaders describe this as a “perfect storm” of challenges, with tariffs being the latest blow to a sector already under pressure from shifting consumer preferences and global economic uncertainties.

In sum, Elon Musk’s renewed dedication to work and Tesla’s strong market response highlight the powerful connection between leadership focus and investor sentiment.

The broader market’s positive reaction to easing trade tensions and corporate developments further supports a cautiously optimistic outlook. Yet looming challenges—from geopolitical trade disputes to sector-specific vulnerabilities—serve as reminders that economic stability remains fragile.

:max_bytes(150000):strip_icc()/GettyImages-2216312549-0c8f151e442146c9b08fa7541319ff3c.jpg)

As Musk doubles down on his commitment to business amidst a complex global landscape, all eyes will remain on Tesla’s performance and the unfolding negotiations shaping international commerce.

The interplay between leadership, market confidence, and policy developments will continue to drive the economic narrative in the months ahead. Investors and analysts alike will be watching closely to see if Musk’s 24/7 work ethic translates into sustained growth and whether the tentative gains in the broader market can withstand the pressures of global uncertainty.