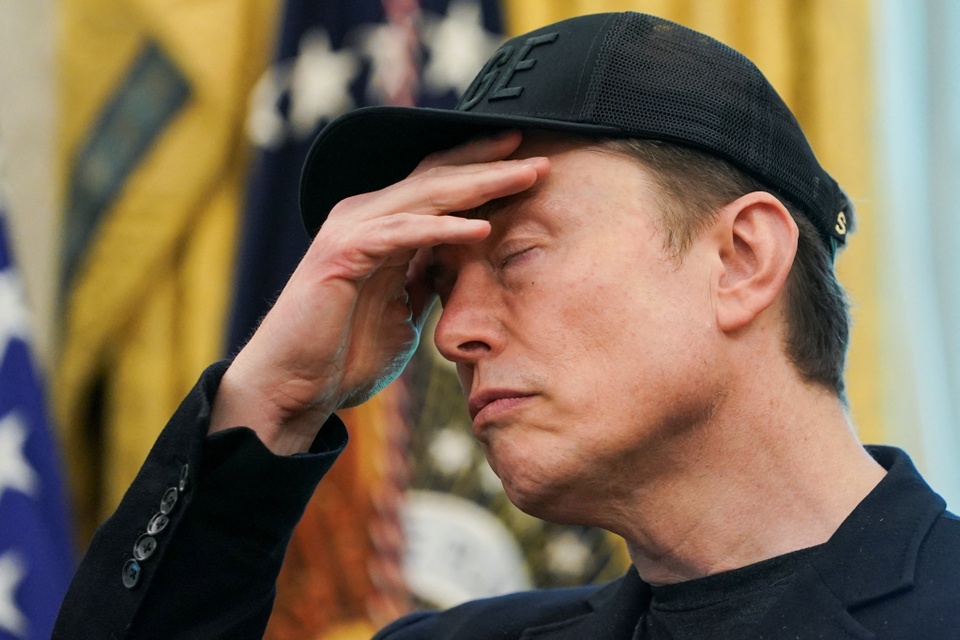

Elon Musk, the world’s richest man and CEO of Tesla, has suffered one of the most significant financial setbacks of his career. On June 5, 2025, Tesla's stock plummeted by 14%, resulting in a $152 billion loss in market capitalization.

This marks the largest single-day drop in the company’s history, causing Tesla’s market value to fall below the $1 trillion threshold, closing at $916 billion. This dramatic decline in Tesla’s value is directly linked to the escalating feud between Musk and former President Donald Trump, who publicly threatened to revoke Musk’s government contracts.

The fallout between Musk and Trump began when the two men publicly clashed over the proposed economic bill, which included cuts to electric vehicle (EV) tax incentives—an issue Musk has been vocal about due to Tesla’s reliance on government support to sustain its business model.

Musk criticized the bill harshly, calling it a “disgusting abomination,” and promised to rally support against Republican lawmakers who voted in favor of it. In retaliation, Trump fired back with a personal attack, claiming that Musk had crossed a line and accusing him of being ungrateful despite the support Trump had given him in the past.

Trump's comment on Truth Social about terminating Musk’s government contracts for his companies was a clear escalation in the public spat between the two influential figures.

The former president also remarked that cutting Musk’s government subsidies would be the “easiest way to save money in our budget, billions and billions of dollars.”

This public rebuke was a blow to Musk, especially considering the billions of dollars in government contracts that SpaceX, one of Musk’s other companies, holds with NASA and the U.S. government. Musk, whose companies have long benefited from government partnerships, viewed Trump’s comments as a personal and professional threat.

In response, Musk took to X (formerly known as Twitter) to defend himself and voice his frustration. He made a bold statement, claiming that without his support, Trump would have lost the 2020 election, and that the Democrats would have taken control of the House of Representatives while the Republican majority in the Senate would have been significantly reduced.

This fiery remark highlighted the deepening divide between the two men, who had once been seen as allies in their shared goals of advancing technology and economic growth.

Musk’s public rebuke of Trump’s proposed economic bill and his claims about the election have fueled tensions even further. While Trump has made it clear that he does not mind Musk’s criticism, he has expressed disappointment in Musk’s actions, particularly after Musk had been given a prominent role as an advisor in Trump’s administration.

Trump’s remarks about Musk’s behavior have only intensified the rift between them, leaving both men embroiled in a bitter personal and professional dispute. The fallout from this feud has had serious financial implications for Tesla.

Following Musk’s comments and Trump’s public threat to revoke his government contracts, Tesla’s stock dropped dramatically, wiping out $152 billion in market value. This massive loss is the largest single-day drop for the company and reflects investor concerns about the growing political turmoil surrounding Musk.

The drop in stock value has caused widespread anxiety among Tesla’s investors, many of whom are now questioning the stability of the company’s leadership and its future prospects.

Musk’s wealth, which had previously been hovering around $433 billion, also took a hit, with his net worth plummeting by approximately $98 billion. Despite this significant loss, Musk remains the richest person in the world, with an estimated net worth of $335 billion, according to the Bloomberg Billionaires Index.

The sharp decline in Musk’s net worth highlights the direct impact that political conflicts and public controversies can have on even the wealthiest individuals, especially those whose businesses are closely tied to government contracts and regulations.

The primary source of contention between Musk and Trump is the proposed economic bill, which includes cuts to incentives for electric vehicles and solar energy, two industries in which Musk’s companies, Tesla and SolarCity, have a significant presence.

The bill would phase out EV tax credits, which have been crucial for Tesla’s success, and impose new fees on electric vehicle drivers. Musk has long relied on these government incentives to keep Tesla’s cars affordable for consumers, and the elimination of these subsidies would represent a serious blow to Tesla’s business model.

In addition to the policy disagreements, Musk’s relationship with Trump has been further strained by the removal of Musk’s ally, Jared Isaacman, from the nomination to lead NASA.

Isaacman, who has been closely associated with Musk through his work with SpaceX, had been a candidate for NASA’s administrator position, but Trump’s administration abruptly pulled the nomination.

Musk viewed this decision as a personal insult, and sources close to him have stated that this was the tipping point in the deteriorating relationship between the two men. For Musk, the removal of Isaacman was a direct challenge to his influence in the space industry, and it deepened his frustration with Trump.

In addition to the personal and political tensions, Tesla is facing mounting challenges in the market. The company has seen a significant decline in its sales in Europe, one of its key markets, and its brand image has become less prominent in Western markets.

Sales of Tesla vehicles have dropped sharply in countries like France, where deliveries fell by 67% in May 2025 compared to the previous year. This decline in sales has raised concerns about Tesla’s ability to maintain its position as a leader in the electric vehicle market, especially as more competitors enter the space.

Tesla is also under pressure to launch its self-driving taxi service, which has been delayed multiple times. Musk had previously promised to roll out the service in Austin, Texas, in the summer of 2025, but that timeline is now in doubt.

Musk’s competitors, such as Waymo, have already partnered with Uber to launch their own commercial robotaxi services, and Musk’s delay in bringing his service to market has caused some investors to question whether Tesla can maintain its edge in the self-driving car race.

Tesla’s stock has already dropped nearly 18% in just one week and is down nearly 30% year-to-date. These declines are a result of both the political tensions surrounding Musk and the ongoing challenges the company is facing in the market.

The political feud between Musk and Trump, combined with the market turbulence, has made for a volatile period for Tesla, with the company’s long-term prospects now under greater scrutiny.

In conclusion, the ongoing feud between Elon Musk and Donald Trump has resulted in a dramatic financial loss for Tesla, with the company losing $152 billion in market value.

Musk’s criticism of Trump’s proposed economic bill and his subsequent public remarks about the election have further deepened the rift between the two men, leading to significant market volatility.

As Tesla grapples with declining sales, delays in key projects, and a political crisis, the future of the company is now uncertain. Musk’s net worth has also taken a hit, reflecting the impact of this public feud on his personal and professional reputation.

As the situation continues to unfold, it remains to be seen how Musk and Tesla will navigate the challenges ahead and whether the company can recover from this setback.